The events of the past quarter hold no superlative or adjective strong enough to capture the disruption and change that many are experiencing. What would have been hyperbole just days or weeks earlier, was quickly becoming our reality. During the past two months, we’ve been introduced to many new terms and experiences like social distancing, sheltering-in-place, and virtual hang outs with friends and family. What was once saved for extreme snow days in Minnesota, distance learning, is now just “school” for millions of children (and parents!) around the country and the world.

No matter the extent to which your life has been directly affected by the COVID-19 pandemic, the emotional impact of these trying times is real and profound. Many have experienced a wide spectrum of emotions—from fear, hope, and uncertainty to concern, compassion, loneliness, and love. These emotions are real, and they all contribute to our wellness and state of being.

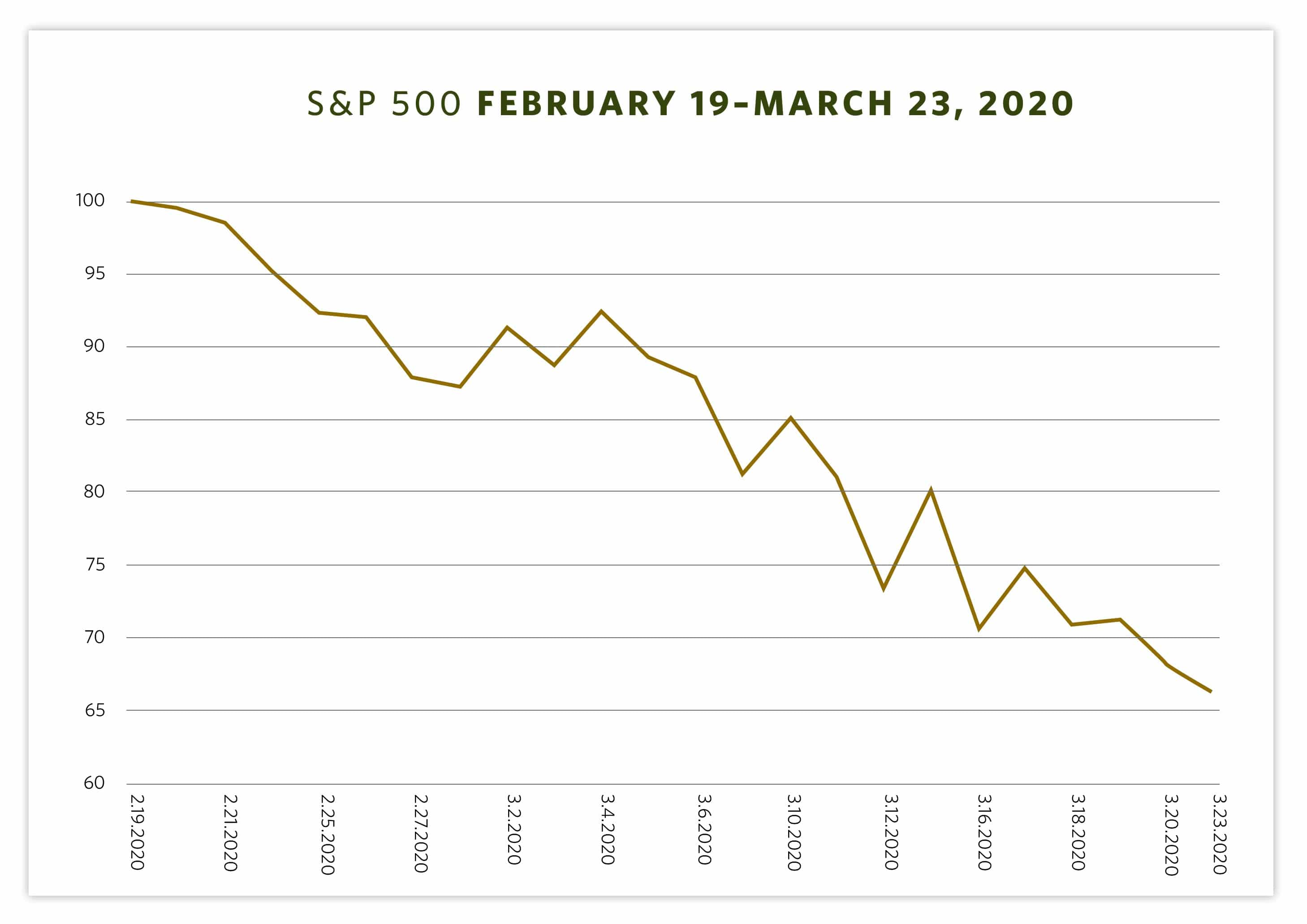

Record-breaking Declines

This time of extremes in our broader world has also certainly been replicated in financial markets and the global economy. In February, the S&P 500 reached its 330th all-time high since the lows of 2009, fueled in part by low unemployment and an economy that seemed to be continuing to move in a positive direction. And yet, in just over one month, the broad stock market fell more than 30%, with new claims for unemployment benefits shattering past records. The daily news related to COVID-19 left many feeling as if we were in the midst of an economy at a standstill. The chart below illustrates the record-breaking decline experienced in U.S. stocks from their highs to the recent lows of March 23.

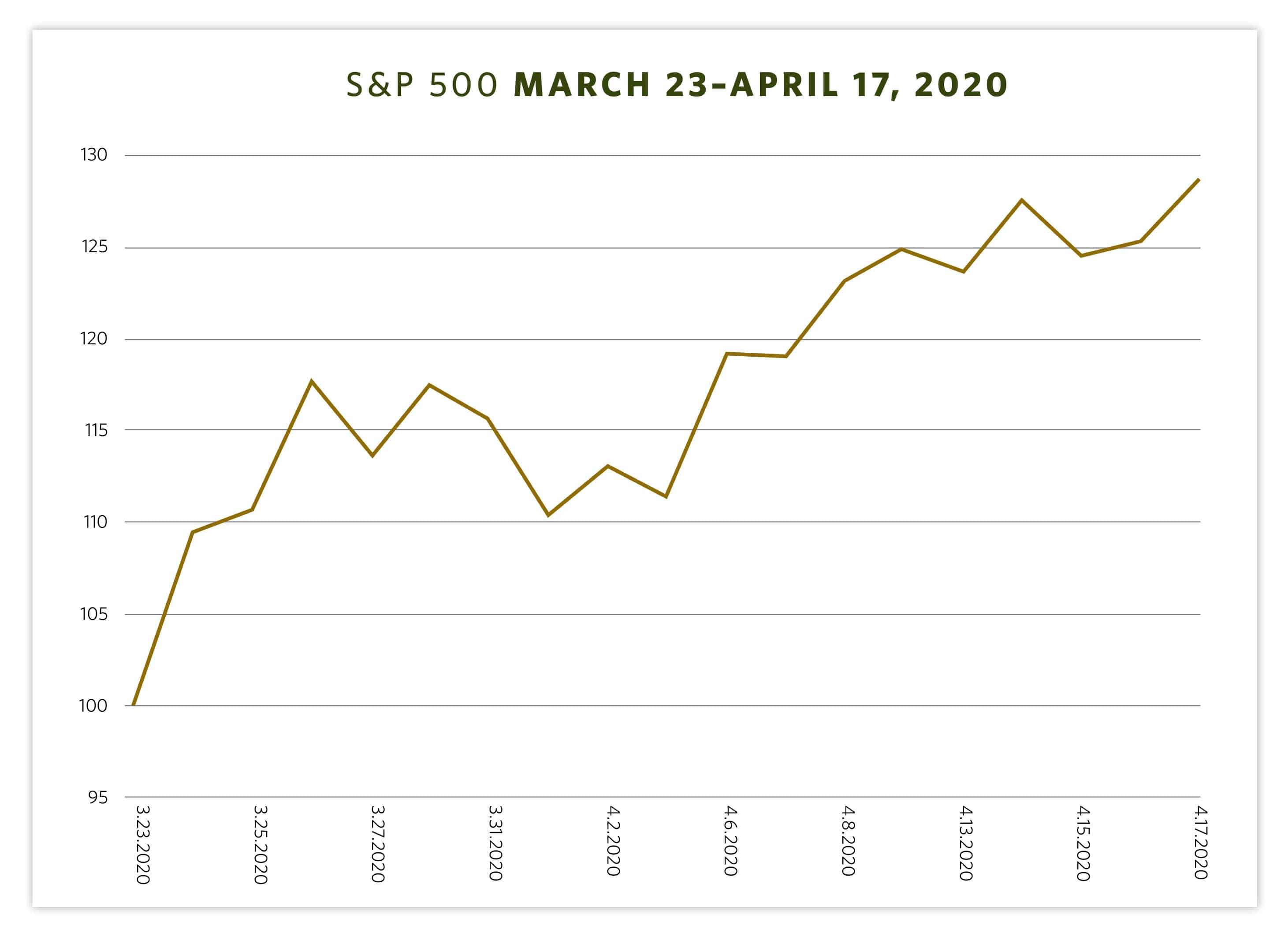

Capturing the Highs

In stark contrast, the next chart shows the returns of the same index since that low. As of April 17, the S&P 500 had increased in value by more than 28% over the previous 18 trading days, the largest increase over such a time period in more than 85 years.

While in the midst of a crisis like this, it’s hard for investors not to feel scared. As a matter of fact, from an evolutionary perspective, some level of fear in times like this is healthy and important to our collective survival. Rational fear can be a positive motivator to take the precautions necessary today, like washing hands, social distancing, and wearing a mask in social settings. Unfortunately, when fear becomes overwhelming it can shift into the realm of irrational fear or panic. The most important and effective way I know to avoid panic is through preparedness.

Preparing for Risk

“No astronaut launches into space with their fingers crossed, that’s not how we deal with risk.”

This quote from Canadian astronaut Chris Hadfield has lodged in my head over the past few months as it resonates with my thoughts about how we structure portfolios, opportunistically rebalance, and work as a team with each of our individual clients. Whether in a time of calm or time of crisis, we’re not crossing our fingers and hoping for the best. We’re constantly planning for risk by working to improve outcomes today, while preparing for what’s on the horizon.

We know that risk of loss in stocks is always present—it’s one of the reasons that returns are higher with stocks than with bonds. The preparedness for your portfolio for these losses comes from knowing that the most important protection from loss is having the right types of bonds in a portfolio to act as a “shock absorber” and protect against a downturn.

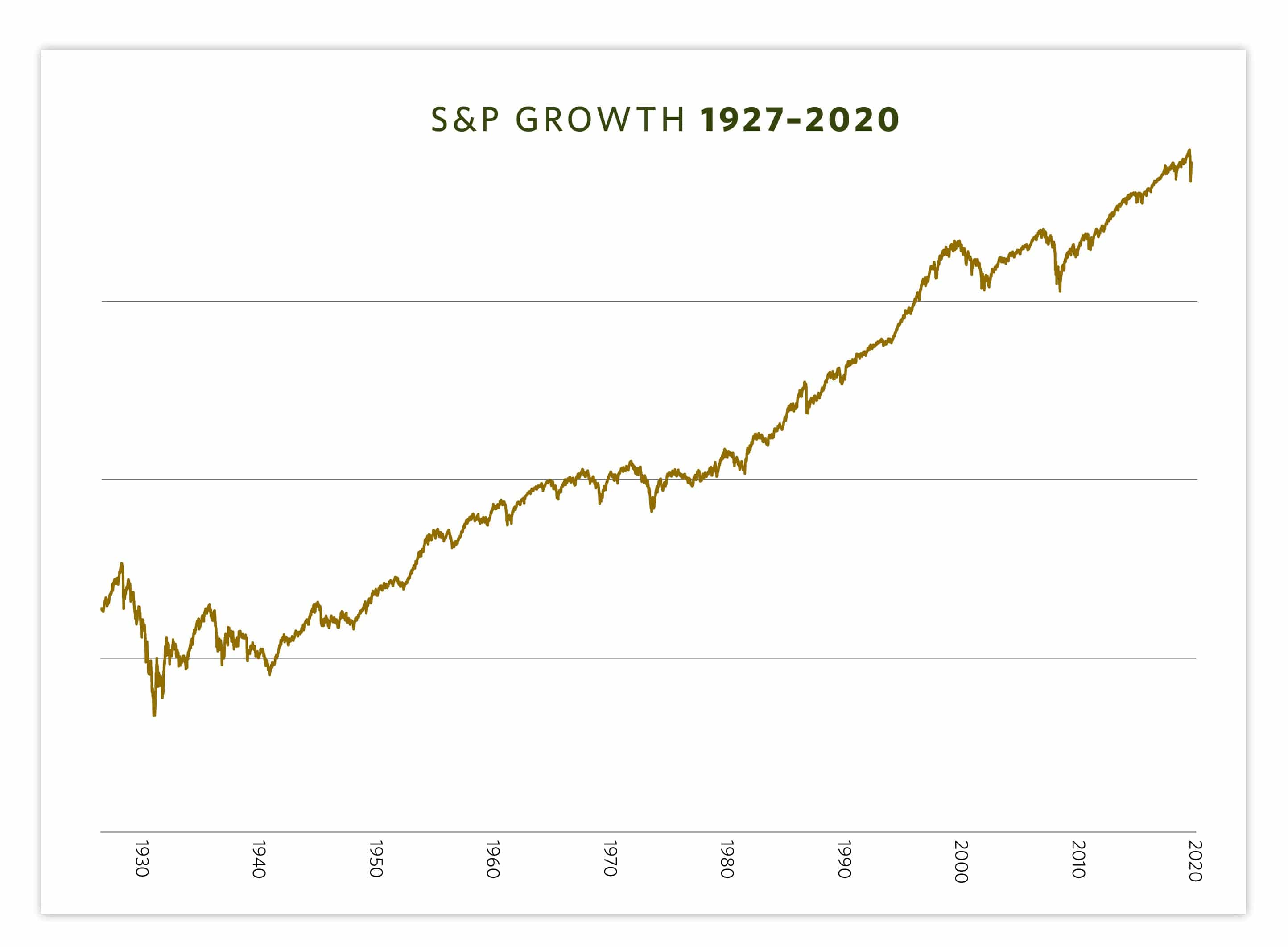

The Big Picture

Although the daily flow and subsequent whipsaw caused by new information, shutdowns, and changes to our daily lives has seemingly slowed, we’re still in a time of many unknowns. Change is not over, and neither, likely, is the volatility that comes with uncertainty. The two charts shown earlier are just snapshots of time—one bad, one good. To prepare for the future, we need to step back and see the big picture, as noted in the chart below. When we do, we see the incredible benefits that have come to those who have been invested in the market over the last 93 years, weathering the 10,692 down days and benefiting from the 12,179 days of growth that have led to the incredible long-term growth of wealth. With this knowledge, perhaps the historic events of 2020 will be shaped into future stories of adaptation, success, challenge, and change.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.