For investors who recall the experience of 1999, it was either a fantastic year or a difficult one, depending on the types of stocks in their portfolio. Investors who concentrated their portfolio among growth companies, which earned little or no profits, remember 1999 as a fantastic year, delivering a return of 41%. Investors with the opposite philosophy, such as Warren Buffett, chairman of Berkshire Hathaway, did not fare as well. Their focus on value companies with large profits lost 5% for the year. This difference in returns, a 46% out-performance for growth stocks with low profits, is by far the largest on record. 1

To make matters worse, 1999 was the second year in a row in which this dynamic occurred. In 1998, growth companies with low profits outperformed value companies by 26%. Investors who traditionally have focused on fundamentals and the quality of corporate balance sheets had never experienced such dramatic results. In fact, it was the first time in history this had occurred two years in a row. Prior to 1998, the single best year for growth companies with low profits was 1967, when they outperformed value companies by 4.8%. 1

From Warren Buffett

As you can imagine, investors such as Warren Buffett were challenged on their investment approach and asked to explain their strong underperformance during this time period. For context, prior to 1998, investing in value companies with strong profits outperformed those growth and less-profitable companies by nearly 7% per year for the previous 35 years. 1 What was happening, and what did it mean for the future of investing?

Mr. Buffet addressed both questions in September of 1999: 2

“Investors in stocks these days are expecting far too much, and I'm going to explain why. That will inevitably set me to talking about the general stock market, a subject I'm usually unwilling to discuss. But I want to make one thing clear going in: Though I will be talking about the level of the market, I will not be predicting its next moves. At Berkshire we focus almost exclusively on the valuations of individual companies, looking only to a very limited extent at the valuation of the overall market. Even then, valuing the market has nothing to do with where it's going to go next week or next month or next year, a line of thought we never get into. The fact is that markets behave in ways, sometimes for a very long stretch, that are not linked to value. Sooner or later, though, value counts. So what I am going to be saying—assuming it's correct—will have implications for the long-term results to be realized by American stockholders.”

Mr. Buffett addressed both the performance of certain types of companies as well as the performance of overall markets, because the two are inevitably linked. The strong performance of stocks where the companies made little to no money was entirely based on market euphoria, where investors were more focused on short-term price appreciation than the long-term fundamentals. Driven by a concentrated group of stocks, the run-up in one corner of the market drove overall market valuations to levels never seen before.

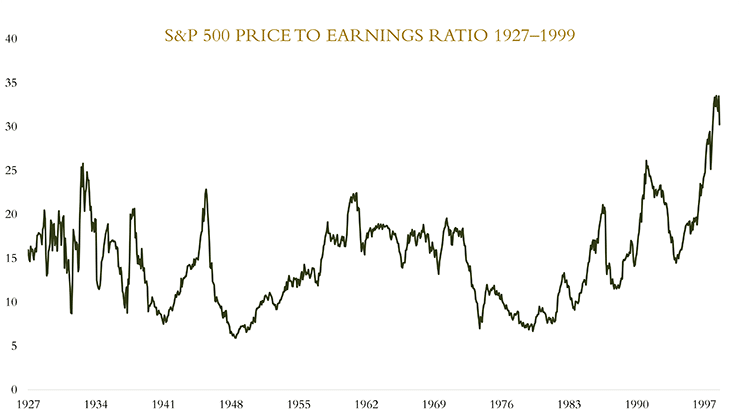

In the graph below, the price-to-earnings for the S&P 500 index is displayed from 1927 to 1999. In simple terms, a price-to-earnings ratio indicates what investors were willing to pay for one dollar of profit. Prior to the run-up in markets in the 1990s, the highest recorded price-to-earnings multiple for the S&P 500 index had occurred during the initial market panic of the Great Depression, at a multiple of 25.

Chart is for illustrative purposes only. Price to Earnings ratio based on data from the S&P 500 for the time period of January 1, 1927–July 1, 1999. Source: https://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart

The Chairman of Berkshire Hathaway summarizes his speech with a forecast of the future. Addressing the crowd, with the market selling at 35 times earnings, 1 Mr. Buffett concludes: 2

“Let me summarize what I've been saying about the stock market: I think it's very hard to come up with a persuasive case that equities will over the next 17 years perform anything like—anything like—they've performed in the past 17. If I had to pick the most probable return … it would be 6%. If you strip out the inflation component from this nominal return (which you would need to do however inflation fluctuates), that's 4% in real terms. And if 4% is wrong, I believe that the percentage is just as likely to be less as more.”

And when you look at history, Mr. Buffet is exactly right. Investors in the U.S. stock market would go on to capture a 5.5% average annual return over the next 17 years 1 because, as Mr. Buffett notes, “Sooner or later … value counts.” 2

Market Performance Today

As it turns out, 1999 is not a once-in-a-lifetime event. Although the dynamics and narratives have changed, recent market performance strongly resembles the environment of the late 1990s.

This year, the market is on pace for a fourth straight year in which the best-performing stocks are growth stocks with low profits. This group, relative to value companies with large profits, has outperformed by more than 100% during this time period. In comparison, growth stocks with low profits collectively outperformed by 68% in 1998 and 1999. 1

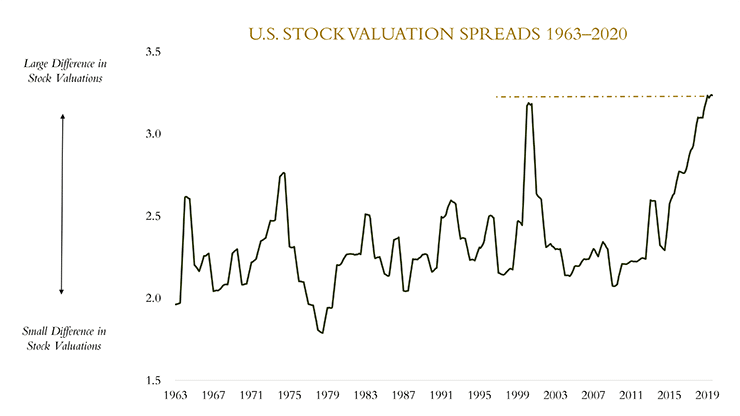

Looking back at 1999, investors shouldn’t have allowed themselves to be fooled into thinking that valuations didn’t matter. The same is true in our current environment. The spread between growth stocks and value stocks is currently wider than any period in U.S. history, including the late 90s technology bubble, as shown below.

Chart is for illustrative purposes only. Data is from the S&P 500, for the time period of January 1, 1963–June 30, 2020. Methodology specifics included below.

Dispersion in the Market

The U.S. stock market today, as a result of highly unusual performance over the past three-and-a-half years, has never been more disperse. There is a large group of growth stocks, selling for a record valuation multiple, that generate very little in profit. There is another large group of value stocks selling for far more attractive valuations (lower multiples), while simultaneously generating strong profits.

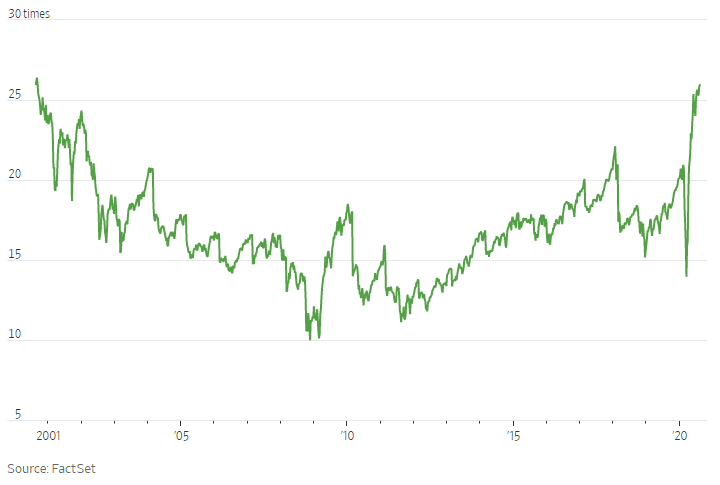

How has this market dispersion affected overall stock market valuations? As shown in the graph below, the price-to-earnings ratio for the S&P 500 has returned to levels only experienced at the peak of the technology bubble. We may not be repeating the technology bubble of the late 1990s, but it certainly feels a lot like déjà vu.

S&P 500 PRICE to EARNINGS RATIO 2000-2020

Chart is for illustrative purposes only. Price to earnings ratio is based on data from the S&P 500, for the time period of August 18, 2000–August 18, 2020. Source: FactSet

“The inescapable fact is that the value of an asset, whatever its character, cannot over the long term grow faster than its earnings do … The absolute most that the owners of a business, in aggregate, can get out of it in the end—between now and Judgment Day—is what that business earns over time.” 2

- Warren Buffett, Chairman of Berkshire Hathaway

What 1999 Tells Us About Today

What Mr. Buffett knew as he was prognosticating, but did not touch on in his 1999 speech, was that the future prospects for market returns as a whole were only of slight concern for value investors. By avoiding or reducing exposure to those expensive and less profitable companies, value investors were able to avoid much of the volatility and loss that resulted in the early 2000s when the technology bubble collapsed. An individual invested in that segment of the market, which had performed so well in 1998 and 1999, would go on to experience a loss of 61% over the following three years. 1 Meanwhile, the group of value stocks with large profits would gain 9% over the same time period, despite an economic recession. 1

Clients of Carlson Capital Management are well attuned to the principles of discipline, diversification, patience, and focusing on what can be controlled. These past several years have put these principles to the test. Just like Mr. Buffett, we will not claim to know what the market has in store for us over the next week, next month, or the next year. However, we, too, believe that value counts. This market has become quite distorted in recent years, and while it presents challenges to portfolios with a value tilt, we cannot let this short-term market performance distort what we know to be true; fundamentals matter.

We encourage all of our clients to appreciate the unique circumstances in which we find ourselves and take comfort knowing that our portfolios are well-positioned as we move closer to the inevitable realignment of market valuations.

View related video content here.

- https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

- https://fortune.com/1999/11/22/warren-buffett-on-stock-market/

Methodology for Chart "U.S. Valuation Spreads 1963-2020: U.S. stock valuation spreads were calculated using market segmentation data from Ken French and Dartmouth’s research database. Investment quartiles were determined using book to market and gross profitability. Valuation spread shown measures the median book to market for the high book to market/high gross profitability quartile, divided by the low book to market/low gross profitability quartile.

NOTE: The information provided in this video is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional advisor familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.