Inflation risk is back in vogue among market commentators these days, thanks to the uncertainty surrounding the future path of the COVID-19 pandemic and the subsequent economic recovery. Some pundits worry about the 70% increase in the Federal Reserve’s balance sheet since March of last year, while others are more concerned that the U.S. budget deficit tripled in 2020, to $3.3 trillion. If the economy recovers strongly, the theory goes that all of this cheap money floating around could lead to a rapid jump in inflation, and now is the time to protect yourself from this growing risk.

We have a few thoughts on this:

- First, these arguments sound very similar to the arguments and fears that were made over a decade ago coming out of the global financial crisis, when the Federal Reserve was announcing substantial quantitative easing programs that had never been used before. Of course, this was followed by a decade of falling interest rates and stagnant inflation.

- Second, most honest economists acknowledge that we have very little understanding of what causes inflation, and outside of the 1970s, we’ve rarely seen anything except stable inflation.

With these thoughts in mind, we do recognize the importance of inflation risk. In fact, inflation is one of the largest single risks that a retiree faces. Consider this: a couple who retire at age 65, spending $60,000 in their first year of retirement, would be projected to cumulatively spend $2.4M over a 30-year retirement. That number assumes a 2% annual inflation adjustment, which rises to $3.4M if inflation turns out to be 4% per year and $4.7M if inflation averages 6% a year. Considering that annual inflation has ranged between 1% and 10% in the U.S. over the past 70 years, it’s possible that higher sustained inflation could occur, and is something that retirees should be prepared for.

Inflation Protection

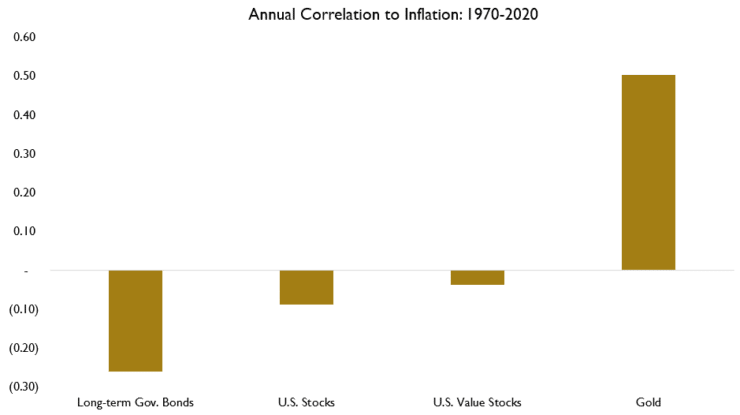

So, how should retirees protect against this inflation risk? Well, no inflation conversation would be complete without considering gold. Intuitively, gold makes sense as a hedge against inflation. Like real estate, we’re not making more of it, and so it should appreciate in value whenever inflation rises. In the chart below, we've measured the annual correlation of several asset classes with inflation, and we see that, in fact, gold prices do rise and fall with inflation, whereas other more traditional investments tend to move in the opposite direction of inflation.

If inflation is an important risk that retirees should be prepared for, and gold does such a good job of protecting against a rise in inflation, why doesn’t CCM recommend an allocation to gold in our client portfolios?

There are two primary reasons. First, when we evaluate the long-term prospects for gold, we see that the return potential is limited. Gold, unlike a stock or a bond, has no inherent reason for delivering a positive return above inflation. The price of gold is entirely driven by supply and demand, which can cause volatility in prices, but is not in itself a reason to anticipate ever-increasing prices. Since 1970, gold prices have done fairly well, rising by 8% per year, roughly twice the rate of inflation. Returns for gold are highly sensitive to the start and end dates. Consider, for example, that gold prices in 2006 were lower than they were in 1980, a negative return over 26 years.

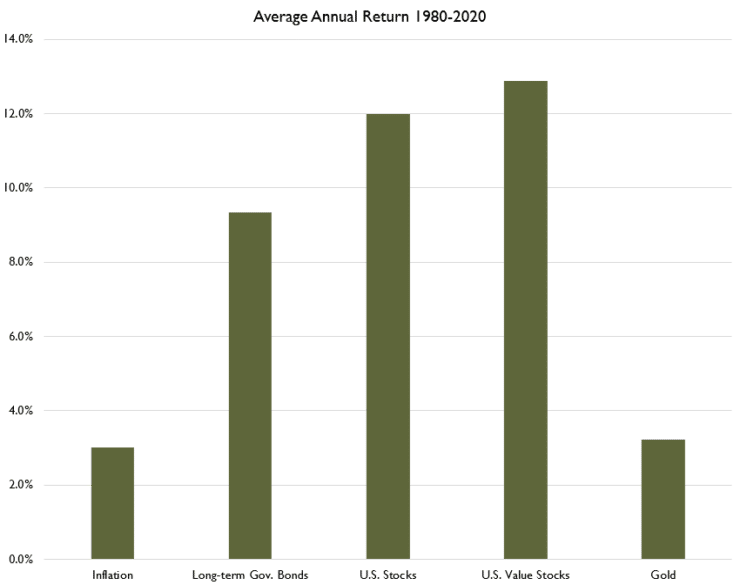

Unlike gold, stocks have an economic reason for delivering positive returns above inflation. Over time, the stock market has delivered an average return of 5% above inflation. As our clients are well aware, we believe that even higher returns can be captured by overweighting stocks with attractive valuations and high profits, and we see in this chart (Average Annual Return 1980-2020) that since 1970, those value stocks delivered an additional 3% annual return.

So, the first reason we prefer not to allocate to gold in a portfolio is because we don’t believe that it will enhance long-term returns for a portfolio, and, because of the volatility in prices, gold makes for a very unreliable long-term investment.

The second reason why we don’t advise our clients to invest in gold is because there are better alternatives to hedging long-term inflation risk, which is what ultimately matters to our clients. While our first chart above highlights the short-term relationship between inflation and several asset classes, we know that a short-term spike in inflation is not the risk that retirees should care about. The real risk is sustained higher rates of inflation for a large portion of a retirement. So, what we care about isn’t the year-to-year relationship, we care about the longer-term connectivity between returns and inflation.

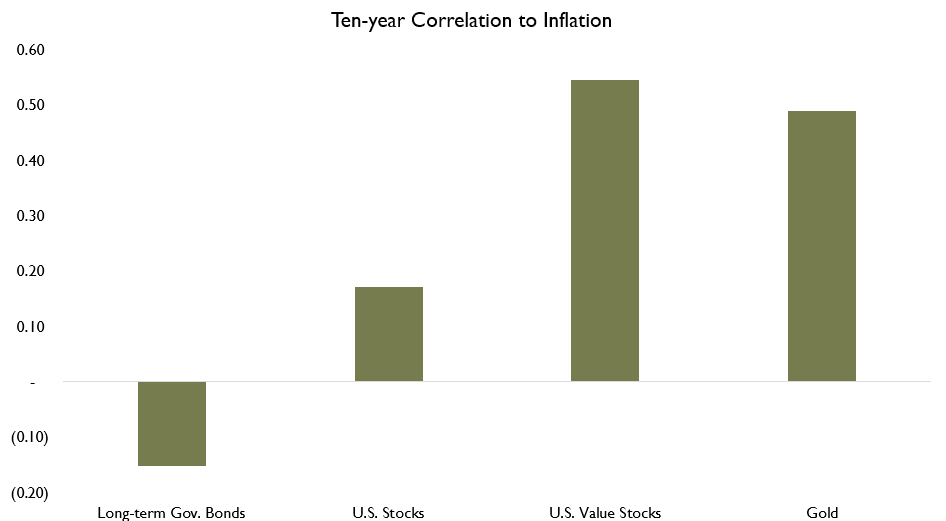

When we evaluate the 10-year correlation of asset classes to inflation, we see that returns for value stocks are just as correlated as gold is with inflation. This tells us that a sustained long-term increase in inflation will likely be accompanied by the outperformance of value stocks, allowing our client portfolios to appreciate more rapidly than the market as a whole.

For short spurts of inflation, commodities like gold will deliver superior returns. However, we don’t believe that investors should spend their lives holding an asset class that delivers inferior long-term returns based on the fear of a short-term event. Value stocks have delivered larger returns for investors over time, and are better positioned to protect against the long-term sustained inflation that can be damaging to the accomplishment of financial goals. Our view is that long-term inflation levels are highly unpredictable, but our portfolios are well-positioned should those concerns be realized.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.