"This too shall pass.” As I’ve aged, this is one of the most important mantras that I carry with me. The origin of this phrase stems back to early Persia, but versions have appeared in many cultures in a variety of forms including songs, poems, speeches, and a screen-printed t-shirt or two. For me, this phrase is an important and constant reminder that neither the bad nor good will last forever.

In my early days as a parent, in those first months and years of seemingly constant change, this phrase helped me get through nights with little sleep and challenging mealtimes with a fussy eater. It’s also been at the front of my mind as my kids have grown to help me appreciate all the wonderful times of joy and happiness, and to choose to be present in those moments before they’re gone.

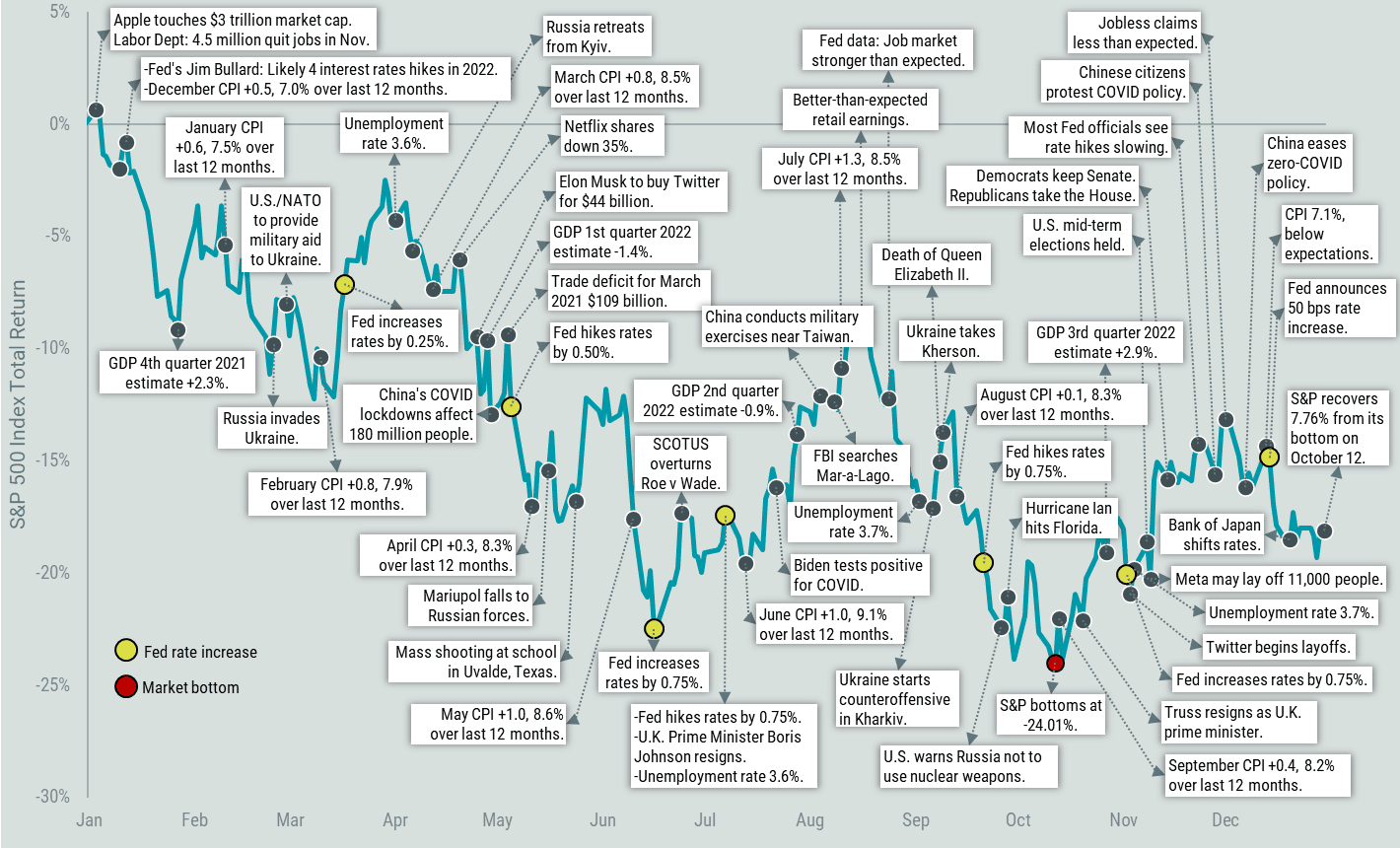

Memorable 2022 Headlines

As you may imagine, this phrase has been key throughout my professional life as well. You may never know when or why or how, but market tides do constantly change. As we left 2021, it was important to appreciate that stock and bond returns that investors experienced over the previous few years weren’t going to persist forever. And as 2022 went along, it was made abundantly clear with numerous unexpected and unprecedented events, that the tides had changed once again. 2022 was a year of seemingly constant change—from the invasion of Ukraine in February to the related global supply chain disruption, to spiking energy prices, to record low unemployment rates, to the highest reported U.S. inflation rates in 40 years, to an aggressive Federal Reserve increasing interest rates, to a mid-term election with a transfer of congressional power. And with each of these events, whether good or bad, high or low, I was sure to keep in mind that this too shall pass.

The main story in 2022 that played a role in nearly every part of our collective economic lives was the persistence of inflation throughout the year. Unfortunately, prices increased much longer and higher than the transitory hopes of the Federal Reserve Bank from 2021. With rates peaking to over 9% when measured year-over-year,1 the Fed took unprecedented action and raised the federal funds rate seven times from 0% to over 4%2 with the hopes of bringing price changes back down near their 2% target. Although price changes are not quite down to those levels, there is hope and data to support that the extreme actions taken are having an effect, with a steady decrease in inflationary numbers since the peak.3

Most of us felt 2022’s ebbing and flowing of prices clearly and prominently at the pump, where the cost of a gallon of gas increased 50% in the first half of the year to peak at over $5, just to fall 38% to end the year at 2022 lows.4

Bond Performance

Directly linked to the rate increases enacted by the Fed to help fight inflation, bonds of all shapes and sizes saw rates sharply increase during 2022.5 Over the long term, this is a strong positive for savers and investors looking to generate stability and income from what can often be a large portion of a balanced portfolio. However, in the short term, rising rates act as a strong headwind for the owners of bonds, as when rates go up, bond prices go down. Fortunately, not all bonds are created equal when it comes to interest rate risk, and there are basic and time-tested ways to mitigate the risk. By staying invested in short-term bonds versus those that mature decades in the future, we were able to avoid the nearly 30% decline experienced by investors in those bonds.6 Losing 5% in bonds doesn’t sound like a win, but on a relative basis, it certainly can be. As rates change and the shape and risk profile of the yield curve changes, we’ll keep a watchful eye for opportunities and ways to continue to manage risks.

Market Performance Alongside Headlines

The stock market also was in a state of constant change with investors incorporating ever-changing news and data into company prices. Whether spurred on by news of developments in the Ukrainian war, COVID policy changes in China, Fed rate hikes, or strong employment data to name a few, the market took investors on a wild ride with plenty of ups and downs, ending the year as the worst since 2008.7 The chart below shows the change in the S&P 500 correlated with dozens of headlines throughout the year. In a year where good news was sometimes bad (in the markets), and bad news was sometimes good, and everything in between, it was helpful to remember that change may only be a moment away.

In good news for investors who focus more of their portfolio towards value stocks than growth, like those managed by CCM, after many years of lagging, value stocks became market leaders in 2022 by outperforming growth stocks by more than 20%.8 In fact, with just this one year of outperformance, large value stocks are outperforming large growth since the March 2020 lows by 23% and small value is outperforming small growth by nearly 50%!9

Looking Ahead

So, what is ahead for investors in 2023? Although we’re off to a strong start, it’s impossible to know where we’ll be 12 months from now. There are likely to be ups and downs once again, as there always are, and whatever comes, we’ll be ready to assist you through it. As long-term investors, we can be confident that the future is bright; and that while down moments may occur, I encourage you to remember this too shall pass.

S&P 500 Index Total Return and Headlines in 2022 Data from January 1, 2022–December 31, 2022

Data represents past performance. Past performance is no guarantee of future results. Table is for illustrative purposes only. Returns are based on S&P 500 Total Returns for the time periods of January 1, 2022-Decmeber 31, 2022. Source: FactSet, Avantis Investors.

Sources for numbers and data cited throughout this summary can be found at:

- https://ycharts.com/indicators/us_consumer_price_index

- https://www.federalreserve.gov/monetarypolicy/openmarket.htm

- https://ycharts.com/indicators/us_consumer_price_index

- U.S. Energy Information Administration, US Regular All Formulations Gas Price [GASREGW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GASREGW, January 15, 2023

- https://fred.stlouisfed.org/tags/series?t=bonds

- Morningstar Direct. Bloomberg Long Term US Treasury TR USD

- JP Morgan Guide to the Markets, Dec 31, 2022. Slide 15

- JP Morgan Guide to the Markets, Dec 31, 2022. Slide 12

- JP Morgan Guide to the Markets, Dec 31, 2022. Slide 12

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.