As humans, we may react emotionally to portfolio volatility, changes in career, or world events. We often feel insecure or out of control during these moments. Feeling secure, particularly financially secure, is just that—feelings. As we encounter these moments of feeling insecure, it is important to think it through: Why do I feel this way? What would make me feel better? How should I react? And then pause before reacting to reflect.

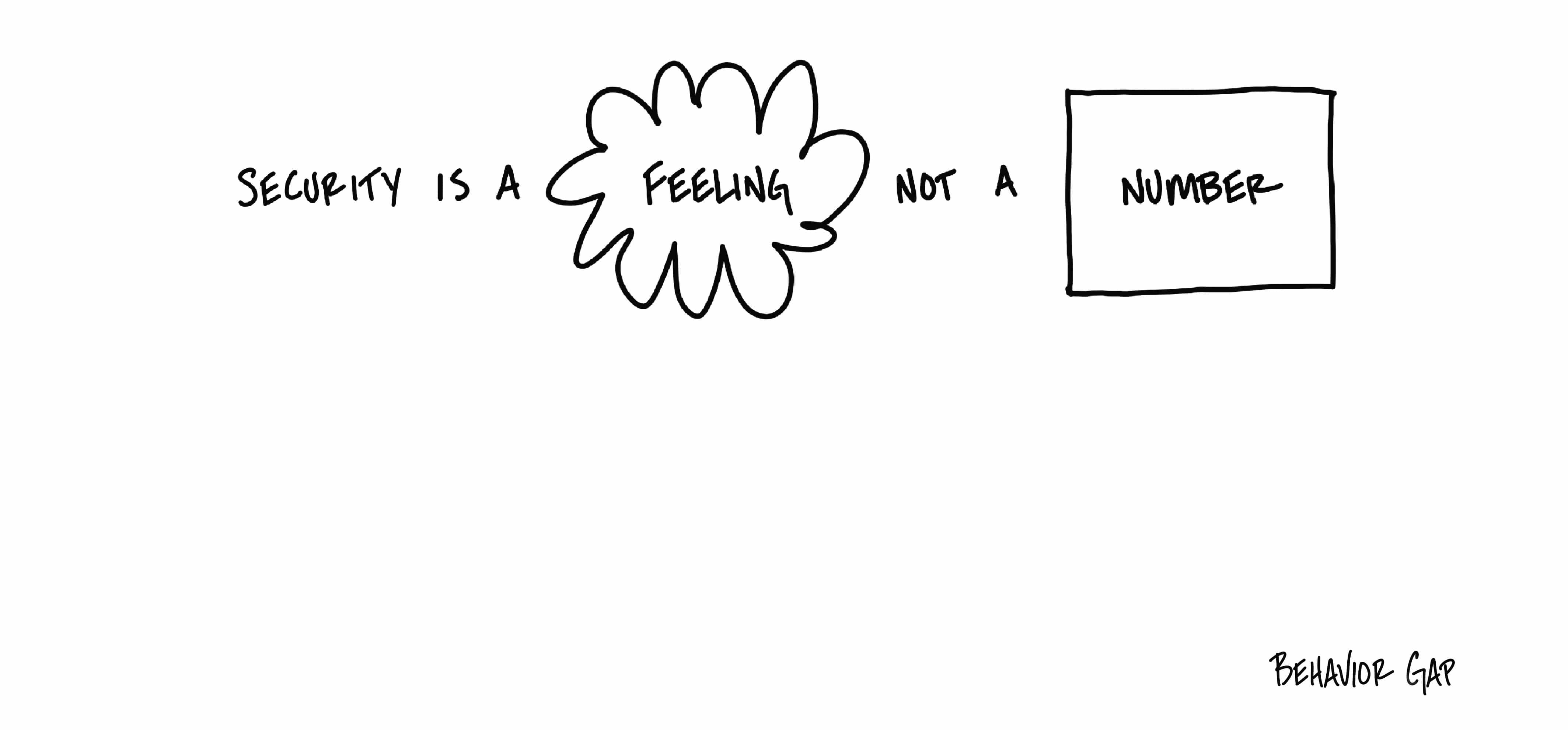

Recently, my spouse and I tried to right-size our emergency fund—the amount of cash we have on hand for the unexpected. As any wealth advisor will do, I went straight to our spreadsheet and calculated the sum of our non-negotiable expenses and multiplied it by the number of months of cash reserves to have on hand as recommended by the financial planning world. With the financial analysis in hand, we reduced the size of our cash reserves accordingly. Unfortunately, this reduction significantly increased my worry and concern. Our cash reserves were now financially optimized—but my sleep-at-night factor was not. Security is a feeling, not a number. Equally so, feeling insecure is never just a number. For us, it was the number coupled with our upbringing, careers, children, world events, and the list goes on.

What Do We Do Then?

First and foremost, we must acknowledge what we are feeling in the moment and then pause before reacting. Then, we can start asking ourselves the following questions:

- Why? What am I feeling and why? Has anything changed in my life? Working together, we can review your goals, objectives, and values.

- What? What was the process we used to build your financial plan and understand your hopes and dreams? What are the facts pertinent to this current moment and the overall financial plan?

- How? How has your financial plan been implemented acknowledging what we learned? If something has changed, how do we adapt?

Financial planning is not static. Not only is the world around us constantly changing, but we as humans are, too. As your wealth advisors, we consider ourselves to be in a sacred space to honor your goals and objectives, and ultimately be a sounding board to help you understand your why. As a firm, our mission is to be a trusted partner that allows you to feel secure in the knowledge that your financial plans are complete, optimized, and integrated in order that you may use your wealth to accomplish what is important to you.

To feel secure, we must ask ourselves the hard questions. What is important to me and why? What makes me feel secure at night? What worries me? Are my actions consistent with my why? Asking these questions may feel uncomfortable. They will take time and effort to answer. But the only way to truly feel secure with a fully complete, optimized, and integrated financial plan is to first define our why. After all, security is a feeling, not just a number.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION.