Over the past week, the banking sector has experienced one of the most sudden and tumultuous downturns since the global financial crisis of 2008–2009. Recently, the most substantial events were related to the failure of Silvergate Bank on March 8, Silicon Valley Bank on March 10, and Signature Bank on March 12.

The Scale of Impact

Although they may not be household names for most retail banking customers, Silicon Valley Bank and Signature Bank are the second and third largest bank failures in U.S. history, trailing only Washington Mutual, which occurred in the midst of the global financial crisis in 2008.1

What Happened, Briefly

Events like these can be unsettling and cause concern about what has transpired as well as what may be yet to come. What we know of the situation currently is that the root of the issue lies in the confluence of several events:

- Rapid growth in bank deposits, mostly fueled by technology and venture capital firms depositing funds which exceed FDIC protection limits.

- Steep increases in short-term interest rates by the Fed.

- Banks’ purchase of investment securities whose market values dropped due to the rate increases.

As a result, when large venture and technology depositors wanted to withdraw their funds at the same time, the banks were forced to sell their securities at a discount or below their purchased value, quickly eroding bank capital. The Fed then made a decision last weekend to take the banks into receivership and safeguard all depository funds.

What You Should Do

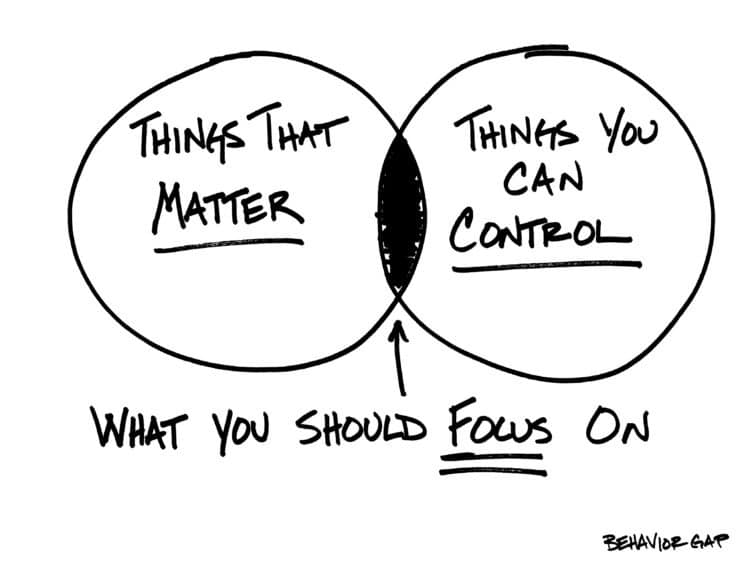

In moments like this, it’s normal to feel a desire to take action and “do something” either to protect or possibly take advantage of an opportunity. As an integral part of your financial planning team, I want to share with you an image that has come to my mind many times over the past few days.

During volatility, there are a few key things that we can control. Since learning of this most recent wave of bank failures, the CCM team has been actively reviewing accounts to ensure your financial goals will stay intact. Many times, this looks like: maintaining a diversified portfolio that matches your risk tolerance, holding assets under FDIC limits to ensure protection, keeping a portfolio from being overly stretched in pursuit of a slightly higher yield, and reviewing the quality and safety of custodial relationships.

It’s important to remember how the things we can control will be uniquely deployed to align with what matters most to you: your goals and cashflow needs, especially. All too often, we’ve seen that if there is a misalignment in understanding what matters most to an investor, it can significantly impact their overall health, happiness, and wellbeing, highlighting the importance of communicating with your CCM Advisor if your goals or cashflow needs have changed.

Helping to Safeguard Your Future

Although volatility like what we’ve seen over the last week can be emotionally taxing for us all, our task remains to position you for long-term financial success. This is the constant focus of our efforts. It’s our pleasure to serve you and help you safeguard your wealth in order that you can use it to accomplish what is important to you. If ever you have any questions, please contact your CCM Advisor.

For Schwab’s perspective on recent industry events, read the letter penned here.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.