The upcoming U.S. election is proving to be one of the most highly contested and polarizing in recent history. With control of the presidency, house, and senate on the line, in addition to a multitude of key state and local races occurring across the country, the stakes are clearly high. Adding further complexity and complication to the mix, we continue to navigate the challenges of a global pandemic, where the health and safety of the electorate are at risk.

It may come as no surprise that the most common questions our investment and advisory teams at CCM have been addressing over the past several months relate to the potential impact of the election on our clients’ investment portfolios. As there are wide ranging differences on policies proposed by each side of the aisle, these questions take on a different inference depending on who’s asking and where one’s interests and political leanings fall. Interestingly, regardless of the beliefs or concerns that may motivate the question, the same answers apply. With the election so close at hand, for this quarter’s insight, we’re addressing two of the most common questions arising.

With all of the uncertainty around the upcoming election, should I go to cash and wait to reinvest until it’s all over?

It’s true that markets typically don’t like uncertainty, and the uncertainty around election outcomes are no different. That said, it is important to know that markets have already “priced in” the likelihood of the uncertainties around this year’s election. This includes the possibility that the presidency and many congressional seat outcomes may take days or weeks to solidify as both absentee and in-person ballots are counted. But even if we knew the results before everyone else, we still wouldn’t know how markets would respond. In other words, it’s most prudent not to make guesses regarding the future and put all your eggs in one basket.

Looking back at the elections of 2016 gives us a clear example of how uncertainties around election outcomes can play out. After a surprise Brexit vote in June in the UK, markets tumbled. Seeing how markets reacted to the unexpected Brexit result, many investors would have gladly sold their stock portfolio to cash ahead of the U.S. election if they knew for certain that Donald Trump would have defied the political prognosticators and won the election. In fact, they would have felt pretty good about their decision as they went to bed the night of the election, with U.S. stock market futures tumbling to massive losses upon the news. However, not only did the markets not post large losses the day after the election, they actually provided investors with gains. Had you sold to cash on Election Day and waited for losses to come, ignoring what could have been substantial potential tax costs, you’d have missed out on nearly a 5% gain through the end of the year in the S&P 500. 1

Is it bad for investors if the White House and Legislative Branch are controlled by the same party?

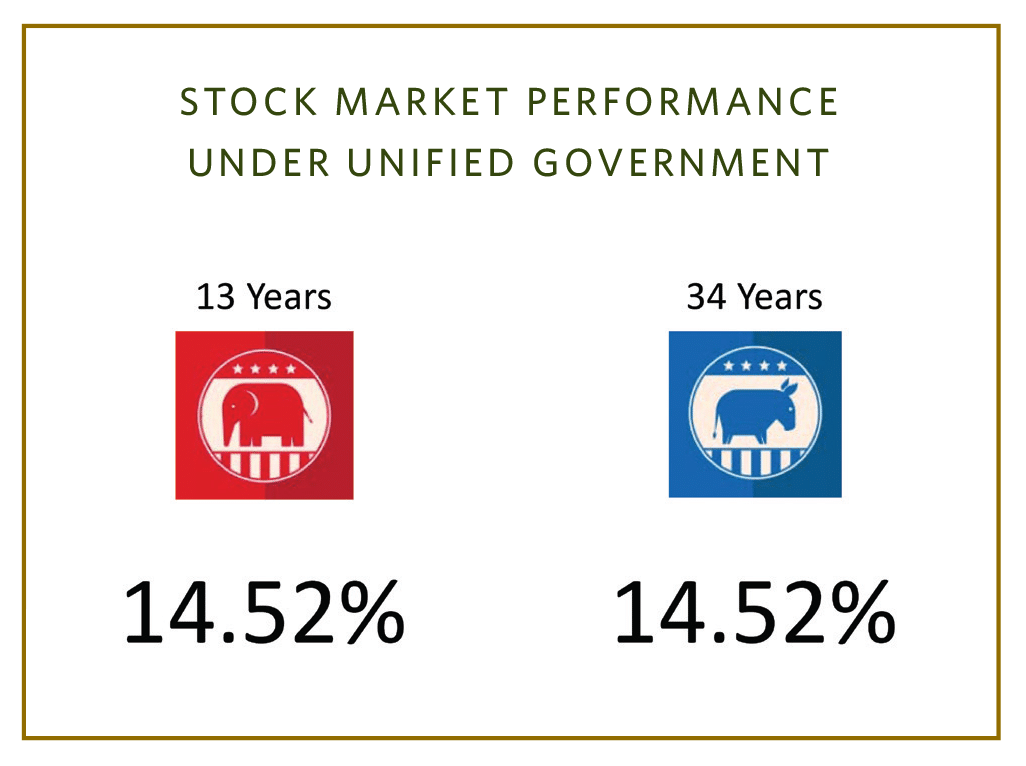

This question is most often asked this year when a client is considering the possible outcome of Democrats unifying these bodies and taking control of the government. This is usually paired with the concern that there would be higher taxes and increased regulation to follow. While this may sound like a reasonable conclusion given the Democratic platform, looking at historical evidence, there is little to support the conclusion that either party is good or bad with regard to expected stock returns. In fact, if we analyze the returns for all of the years that each party has had such a monopoly, they end up having had the exact same average returns.

How to Best Manage Uncertainty

While it can feel less than satisfying to stay the course in the face of so much uncertainty, we can draw confidence in applying historical outcomes to our present situation. Knowing that while “today may be different,” uncertainty, surprise outcomes, and political conflict have occurred in the past as well. We can also remind ourselves that markets are constantly pricing in uncertainty, and accepting risk is one reason stock investors are rewarded long term with higher returns.

In short, don’t let any emotions related to politics guide an emotional reaction related to your portfolio. We believe the best way to manage through our world’s ever-changing landscape is to have a well-designed, comprehensive plan that integrates all of the various disciplines of one’s financial life. Although we don’t know what will happen regarding next month’s elections, with our experience and team of advisors and specialists at CCM, we are preparing for a variety of outcomes so that we can continue to act in your best interests.

- Yahoo! S&P 500 November 8, 2016–December 31, 2016.

NOTE: The information provided in this video is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional advisor familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.