I recently attended a charity fundraising dinner that included a very shrewd strategy to help maximize the funds raised for the organization. The evening was not unlike many others of its kind. Whether it was through silent and live auctions, raffles and door prizes, or directly pledging gifts, there were ample opportunities throughout the night for attendees to participate and extend financial support to the organization.

What caught my attention was the fact that nearly everyone who came stayed through the entire evening’s ceremonies, increasing the organization's opportunity to raise additional funds. I was surprised not to see more people leave after the cocktail hour and silent auction. Similarly, hardly anyone left after the dinner and raffle. Instead, the vast majority of attendees were in their seats until the very end of the late weeknight event because of six simple words: You must be present to win.

You see, the strategy that this organization used to keep attendees glued to their seats where they were much more prone to give as compared to sitting on their couch at home was to have a raffle of a material cash prize at the end of the night’s festivities. The odds weren’t great, maybe one out of one hundred, and the prize wasn’t life changing by any stretch; but it was certainly enough to keep people engaged. And although I didn’t end up as the big winner for the evening, I left with that six-word phrase resonating in my head. Ever since, I have thought of it as a mantra for capital markets and investor behavior.

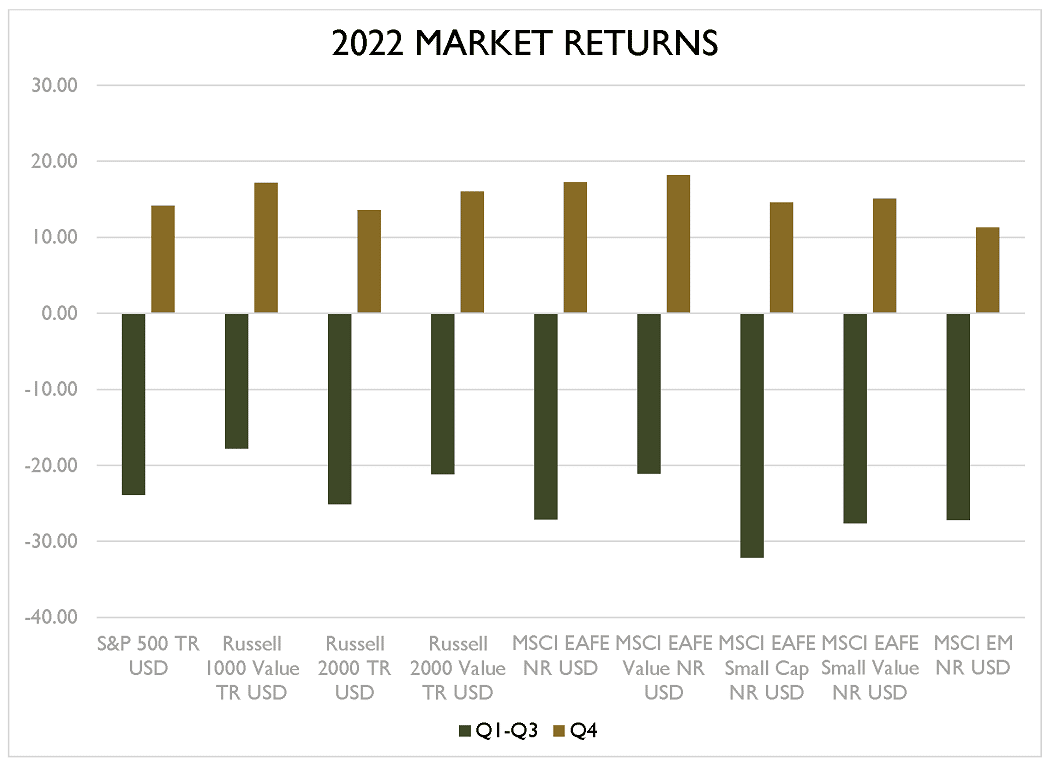

Like most years, 2022 has been filled with market ups and downs that we’ve all had to weather. In the first part of the year, all that seemed to be going up were interest rates and inflation, while all that seemed to be going down were asset prices. And during what seemed to be constant headlines about runaway inflation or uncontrollable interest rates, it was very reasonable to feel nervous about your personal financial situation. Lower portfolio values and increased costs are never a comfortable combination. However, hopefully there was some comfort felt in the Plan Effect and in the reality that situations like we experienced in the first nine months of the year are a part of the stress testing we do each and every day for our clients.

Little did I know that when I wrote about the Plan Effect in October, it would turn out to be the market bottom for many major stock market indexes. I also had no way of knowing that in the subsequent two months, major stock market indexes across the world would be up double-digit percentages, with many pushing 20%. I simply know that in order to increase your chances to succeed and to obtain the returns that reward investors for accepting the risks of broadly diversified global stock ownership, you must be present to win.

There’s no guarantee that any investment will grow in value. But given that over 70% of years since 1926 have S&P 500 returns in the black,1 for most of us those are odds worth sticking around for.

- Morningstar Direct. S&P 500 TR. Annual returns 1926-2021.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.