The ability for investors to access stock and bond markets has evolved considerably over the past 50 years. Long gone are the days in which only the extremely wealthy had access to these markets through brokers directly connected to Wall Street. The idea of taking a call in order to be pitched on a handful of individual stocks likely to “hit it big” may seem foreign today, but it wasn’t so long ago when that was exactly how portfolios were built. Unfortunately for those investors, although it wasn’t certain whether the pitched stocks would be winners or losers, what was known was that they were going to have to pay high commissions in order to find out.

With the original stock broker structure eventually giving way to mutual funds as a primary means for investing, a much larger population was granted access to diversified investment portfolios. Although an improvement over the past, the early days of mutual fund investing still put the weight of high fees and commissions on investors. Fortunately, those frictions were reduced over time. The shift away from high cost active management to the democratization of investing in the form of low-cost index and systematic asset class funds that no longer carried commissions to buy and sell was transformative.

And although great improvements have been made over time, and the value of those improvements has been passed on to investors, mutual funds still carry structural challenges for how investors are taxed as a part of ongoing fund ownership. These tax-efficiency challenges are one primary reason for the advent of exchange-traded funds (ETFs) and are a large factor in their continued growth relative to mutual funds.

Along with greater access to an ever-expanding opportunity set of innovative strategies and what can often be lower cost alternatives, the greater tax efficiency of ETFs compared to mutual funds is a primary driver for CCM’s shift in utilizing these vehicles with the goal of improving our clients’ net after-tax returns.

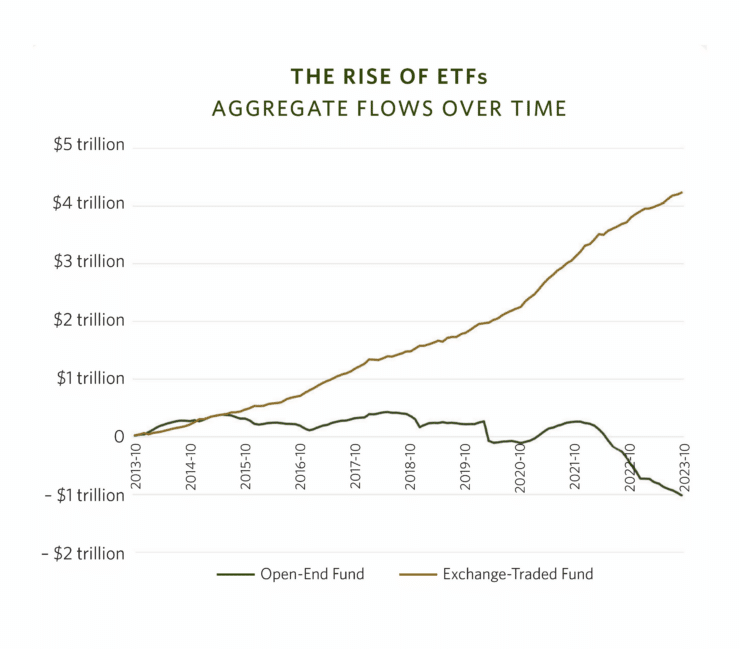

Don’t just take our word for it, one real time way to see this evolution unfolding is to look at where investors are allocating their dollars. The chart featured here shows the flow of investor capital over the past 10 years to both mutual funds and ETFs. Over the past decade, more than $1 trillion has flowed out of mutual funds while more than $4 trillion has flowed into ETFs.

With firms like Vanguard continuing to see the majority of investors’ cashflows going to ETFs over mutual funds, and legacy mutual fund manager Dimensional Fund Advisors actively converting billions of dollars worth of their longstanding mutual fund strategies to ETFs, we continue to see a future with ETFs leading the way.1

- Morningstar Direct Estimated Net Flows for Vanguard data. https://www.dimensional.com/us-en/newsroom/dimensional-lists-four-new-etfs-following-the-industrys-largest-mutual-fund-to-etf-conversion for Dimensional.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.