Last week, we provided historical insight into equity market valuations and the implication for future returns in investor portfolios. This week, we’re shining a light on the "shock absorber" within client portfolios—fixed income. A popular topic of conversation in recent years has been whether investors should abandon traditional fixed income investments for higher-yielding investments or pursue new, alternative investment strategies instead. Our philosophy at CCM has always been that fixed income investing must complement a globally diversified portfolio of stocks.

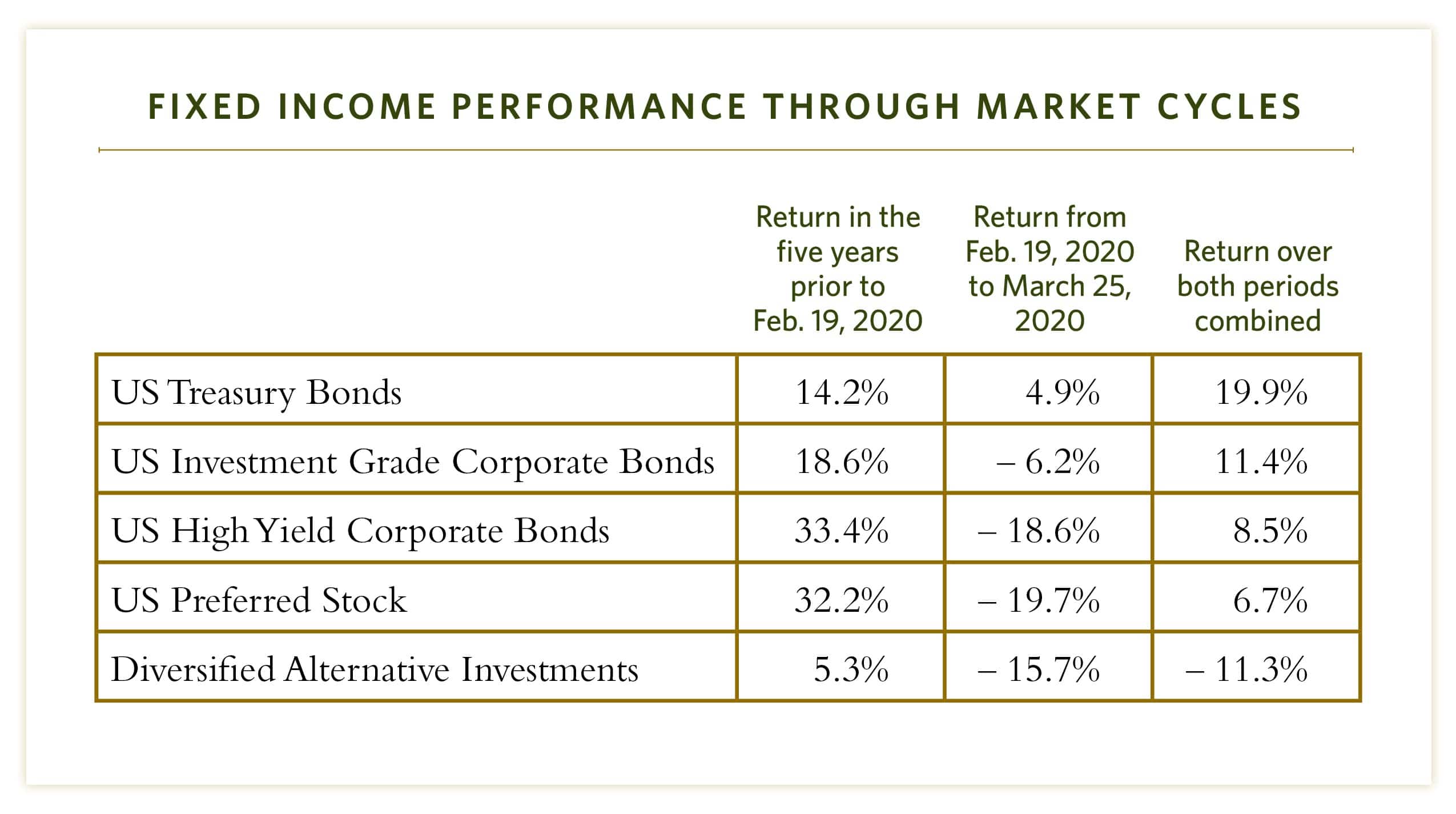

The table below presents returns across three time periods. The first column shows performance for the five years prior to this recent downturn. The second column shows investment performance during this most recent downturn, through Wednesday, March 25. The last column shows performance for both periods combined. Investors should understand that there is simply no alternative for safe fixed income within a portfolio, represented here by U.S. Treasury Bonds. While some strategies that offer attractive yields may outperform during time periods where equities are performing well, they rarely hold their weight during times of market volatility, which is exactly when you need your shock absorber the most.

We know that better returns can be generated in fixed income by taking on more risk, but doing so will produce less-desirable long-term portfolio results. Owning safe fixed income that performs well during market downturns helps to not only offset the risk of stocks in your portfolio, but also provides for more advantageous rebalancing opportunities.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.