Investors are prone to recency bias, a key aspect of behavioral finance that favors recent events over historic ones, and as an example, can result in focusing on companies that have generated the best returns in recent years as opposed to taking a longer view. What's important to remember is that, over time, each area of the market has its moment in the sun; internet stocks in the late 90s, commodities and real estate in the early 2000s, alternative investment strategies during the global financial crisis, and so on. Many DIY investors, either intentionally or unintentionally, tend to accumulate larger-than-normal positions in these stocks, right before their run of superior performance ends.

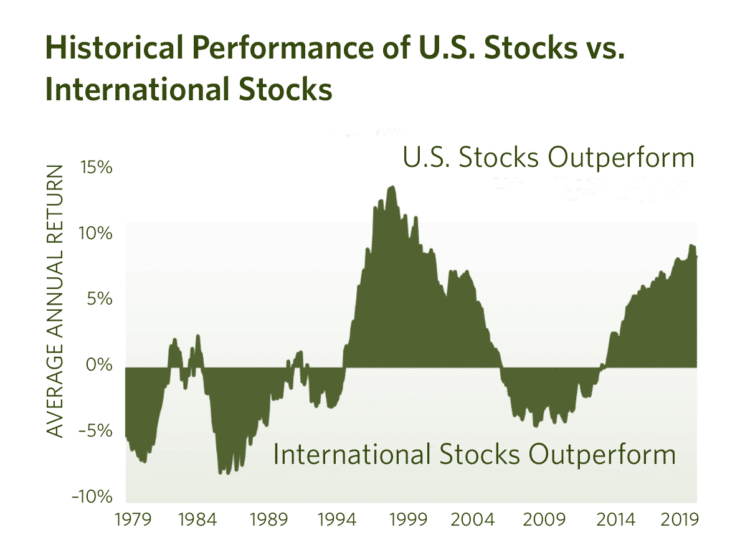

One area of the market where some investors might be currently prone to recency bias is related to U.S. stock performance. The S&P 500, an index comprised of the 500 largest U.S. publicly traded companies, has outperformed a diversified index of international stocks by 8.9% per year, over the past 10 years.1 This outperformance has increased the weighting of U.S. stocks in most investors’ portfolios. A historical review of global stock performance shows us that U.S. stock outperformance is hardly the norm, and we may very well see international stocks lead over the coming decade.

Returns from January 1, 1979 - June 30, 2021

Returns are based on data for the time period of January 1,1979 -June 30, 2021. Source: S&P 500 TR Index. MSCI World ex USA Index.

Another way that recency bias can manifest to the detriment of investors is during times of particularly strong volatility. Recency bias comes into play when we begin to believe that a declining market is sure to keep falling, or conversely, that a rising market is going to continue on that course. This can, of course, lead to a decision-making process with negative consequences.

At CCM, our investment philosophy is intentionally designed to guard against recency bias. We're intensely devoted to understanding your long-term goals and developing a globally diversified portfolio that supports them and guards against overweighting an asset class that may underperform in the future. In addition, we take our responsibility as a fiduciary partner very seriously, providing unbiased counsel that removes emotion and is steeped in academic research.

As always, if you have any questions about CCM's investment approach, we encourage you to reach out to your advisor, contact a member of our Investment Team, or explore the information available on our website.

- S&P 500 TR Index, MSCI World ex USA Index, January 1, 1979 - June 30, 2021

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.