With many employer-based retirement plans (i.e. 401(k) or 403(b) plans) now offering a choice between making contributions into a Roth or a Traditional option, a conversation we frequently have with clients centers on the difference between contributing to one versus the other. As with most financial and tax planning questions, the answer depends a great deal on your personal situation, but there are several factors that are generally the most important to consider in deciding if a Roth is a good option for you.

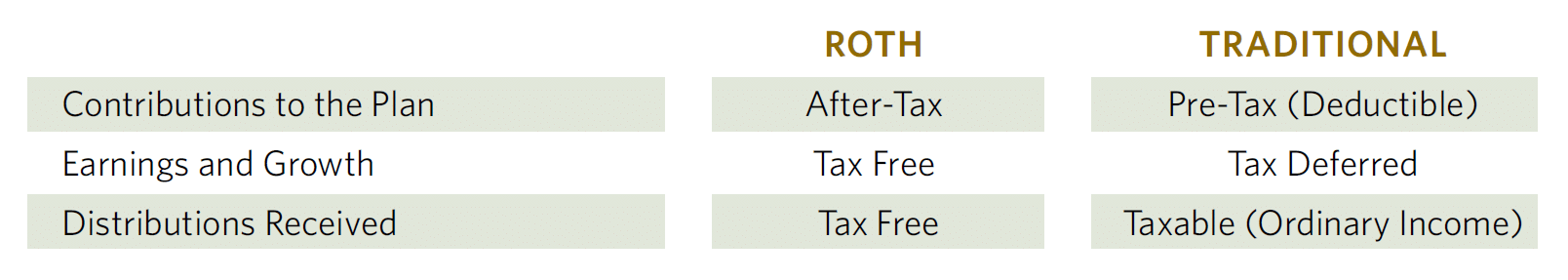

The key differentiation between the two has to do with when the funds contributed to the plan are taxed. The table below reflects the tax characteristics of each option:

Should I pay taxes now or later?

Making contributions to a Roth requires that you pay more taxes now. It is often a difficult choice to decide to pay more taxes now, but the choice can be advantageous if you believe your current tax rate will be lower or the same as your future tax rate. Here are some situations or scenarios to consider:

- You are a younger worker expecting to earn more in the future.

- You are a young single income family that expects to become a dual income family in the future.

- The Tax Cuts and Jobs Act of 2017 placed you in a lower tax bracket in 2018 as compared to 2017.

- You expect your tax rate during your retirement years to be lower or similar to your tax rate during your working years.

- You expect future tax rates to be raised by Congress for all income levels.

Will I save more with a Roth?

Contributing $1,000 into a Roth 401(k) is saving more for retirement than contributing $1,000 into a Traditional 401(k) after accounting for the impact of taxation. For example, if the $1,000 in each account never grew and was then distributed in full at retirement, you would have $1,000 to spend from the Roth 401(k), but you would have to pay taxes on the $1,000 distributed from the Traditional 401(k) leaving you with less to spend. In order to make the savings equivalent, you would also need to set aside (save) the immediate tax savings resulting from the contribution to a Traditional 401(k). We find that most employees do not formally follow this practice. Therefore, in many situations, choosing a Roth will result in a far greater accumulation of spendable assets for retirement due to this added “forced” savings.

These are just a few of the key considerations around this question. If you would like assistance with how to analyze and decide on the best choice for your situation, please reach out to your CCM advisory team.

NOTE: The information provided in this article is intended for clients of Carlson Capital Management. We recommend that individuals consult with a professional adviser familiar with their particular situation for advice concerning specific investment, accounting, tax, and legal matters before taking any action.